Why personal finance should be a required course

Sophomore Kaitlyn Stievater expresses fear of being trapped in the never-ending cycle of bankruptcy. If she were to take Personal Finance, she could learn the multiple ways of avoiding financial mistakes.

Senior Kate Silverman wishes she had learned how to file taxes, how to maintain a credit card, how to finance a house, how to reduce college debt, and how to open a savings account in one of her four years of high school.

“I’m most scared that when I leave college and get a real job and have to be independent, I won’t know how to survive financially. I would have to YouTube or Google everything. If we had a class that taught this, I would feel much more comfortable being on my own and knowing how to take care of myself,” Silverman said.

We do have a class that would have taught Silverman how to take care of herself: Personal Finance, currently an elective.

If Personal Finance was required, students would be financially savvy and not dependent on family members or the internet to make basic life decisions.

Senior Chadwick Cole, who took Personal Finance, agrees that this class should be mandatory for all students because most classes don’t prepare students for the real world but everybody is going to have to do what is taught in personal finance.

“If students don’t have these skills, they will be financially blind. In the class, you learn about real-world finances, including the I9 form for employment eligibility. We also learned about how to get financial aid in college and how to file taxes, for example, the rules for how much you make before you need to file and other tips for doing your own taxes. Overall, the most helpful part of this class was that the content was relevant. Ironically, right after the class taught me how to fill out a W2 form, I was given one for an after-school job and felt comfortable that I filled it out correctly,” Cole said.

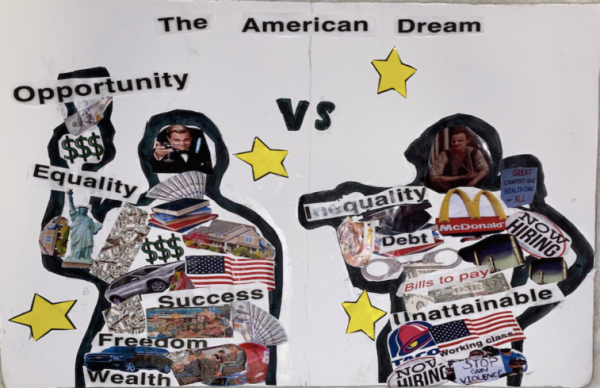

School is supposed to be our foundation for life, yet we aren’t receiving some of the vital information to create a strong foundation. Once students leave their nest and live without the guidance and financial support of their parents, the opportunities for financial mistakes increase greatly.

Smith’s college experiences at Miami in Ohio helped her avoid financial pitfalls where she learned how not to be scammed during freshman orientation.

“This was a college crash course when we started there because you would see all the credit tables and ‘Get a free Miami T-Shirt if you sign up for the credit card’, and I saw so many people do that. I would tell them, ‘Didn’t you listen? Don’t get a credit card you’re only 18’, But I did not take a Personal Finance class. Thank goodness they gave us this ‘How not to Get Scammed Lesson’ because I probably would have been like ‘Free t-shirt?! Cool!’ And got me into a situation where I didn’t belong,” Smith said.

It is easy to be scammed if you don’t have the resources to keep you out of trouble. Knowledge is power, and not all colleges provide students with the knowledge Smith learned. By making Personal Finance mandatory, students could avoid disastrous financial decisions. While students won’t leave a financial wizard, they will have a basic understanding of how to avoid crippling debt, and make smart financial decisions, know what they’re agreeing to when they sign up for credit cards, loans, and file tax returns.

Personal Finance teacher Derek Puishes highlighted key areas in the curriculum of the course that guide students through decisions nearly all adults face.

“Taxes are our first unit, how to file, what they are. Then we go into banking, saving accounts, and checking accounts. Then we go into different ways to pay for college. We get to creating a budget, then how to allocate all of your income, and then we get to credit: managing your credit, credit cards, and your credit score,” Puishes said.

This class creates a balance between being taught through a PowerPoint and an interactive environment to engage everyone. Puishes always has games and activities prepared to increase participation as well as reward those who take part in the discussion. The class is designed to be very stress-free as students never receive homework and always receive more than a sufficient amount of class time to complete assignments, assignments whose lessons last a lifetime.

Puishes makes the theoretical-practical as students in his class complete various simulations to experience what they are being taught.

One simulation, which is also a part of the final, was “the Budget Game” on Personalfinancelab.com. This simulation, while very frustrating, was even more enlightening. We didn’t have any control over certain purchases we had to pay off and were often greeted by unpleasant surprises that we had to pay for as well. It made us aware of all the unexpected expenses that come with the real world, situations that students usually never think about. I remember having to pay the exterminator because I had avoided doing my chores for too long and had a bug infestation, or having to pay multiple speeding tickets. Trying to maintain a good credit score, increase the amount of money in your checking and savings account all while trying not to go bankrupt can be pretty difficult. On top of all this, we needed to maintain a good mental spirit by taking into consideration the distribution of our time to our studies, social life, work, and chores. I remember sitting in class, frustrated, as I chose to study as my option one time and had to pay $17.00 for a snack I bought. As I was trying to boost my quality of life score by socializing with friends, I also ended up paying $88 for snacks; my frustration with the game greatly increased. However, this is the reality of expenses, and, if students don’t budget properly and allocate their money the right way, these expenses can mount and financially crush students.

This game shows how much it really costs when all your bills come together: phone bill, rent, car insurance, car payment, energy bill, tv/internet. The game also taught us the amount of thought that goes into deciding which plan you will choose for all these bills and which desires you will have to limit to maintain financial stability.

Students also have to decide which bank is most beneficial towards their needs, by taking into consideration the services they offer and the fees they might require. As parents will eventually stop paying students’ phone bills, students will need to decide what phone company they go with and who offers a better plan. Puishes taught us that it is extremely important to not always go with the first offer and consider at least two or three different options to make the smartest financial decision. For example, when buying a car, students want to avoid naming the price before the dealer does to avoid stating a price higher than in the dealer’s mind. Not only this, but students should be visiting more than one car dealership before buying their car to snag the best deal.

Whether it be through the games, through the many class discussions, or through the helpful worksheets, simple exposure to this information can go a long way to making students financially savvy.

“Taking this class you’re not going to become a money expert overnight, but you know the first time I was exposed to this information was college. I learned the different types of investments, stocks, bonds, mutual funds, and ways to buy a house. And what a mortgage is,” Puishes said. “When I was going through it the first time, I felt lost a little bit, especially when I was buying a house when I was buying a car when I had to apply for credit when they told me my credit score was slow because I didn’t have a lot of credit history. Creditors said: ‘You made all your payments on time, but you just don’t have a lot of credit history.’ I didn’t really understand that, and I hope that at least hearing about it in these types of classes taught at Groves, helps students when they hear it again in the real world. Students can at least be like: ‘Oh yea, I know what that is, and I’ve experienced it before.’”

Personal Finance is such a valuable course, but, as an elective often goes unnoticed in our course catalog. Dr. Smith and Puishes’ first exposure to financial information was in college. However, college is usually the time where students start looking for jobs, and nowadays, many teenagers are already working in high school. Students and parents are also burdened with paying much higher college tuition.

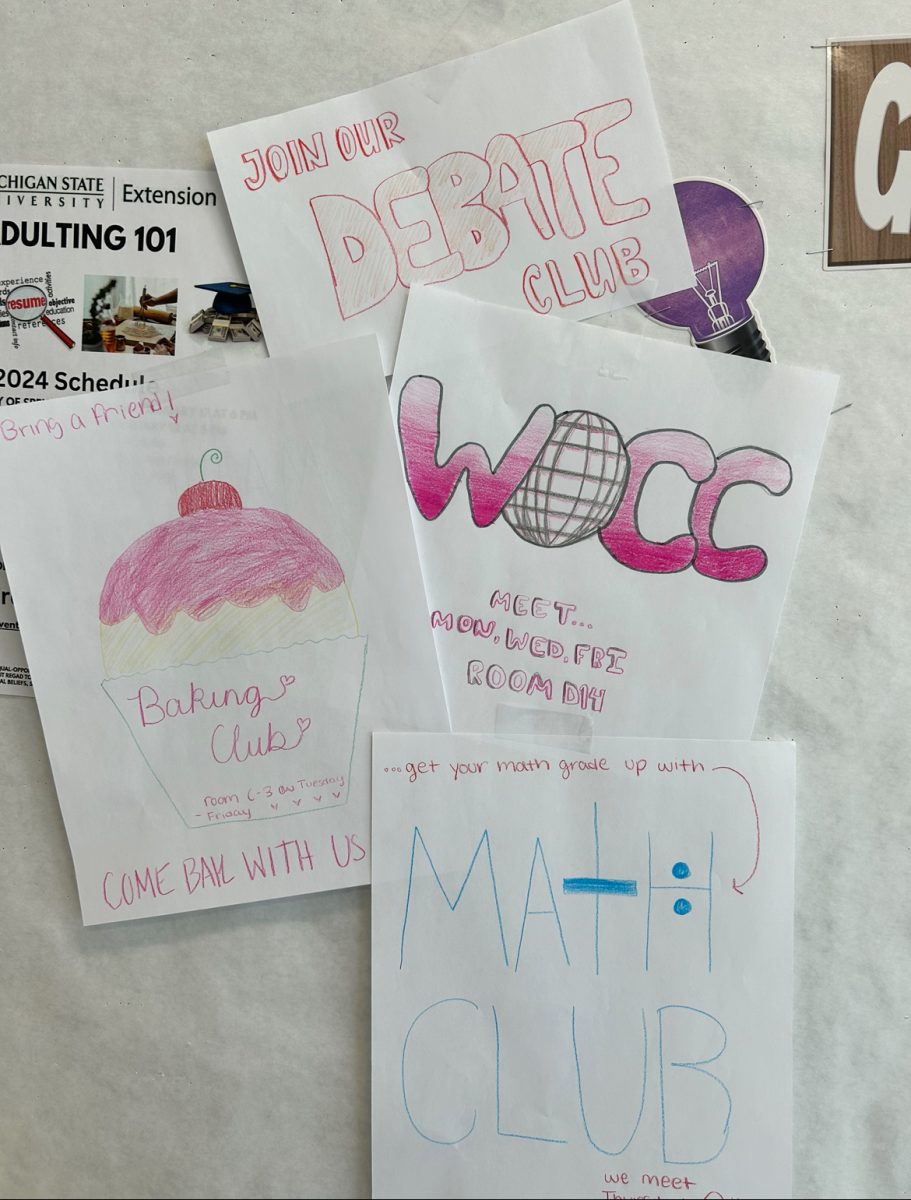

It’s a good thing that personal finance includes a unit dedicated to how to pay for college. While Personal Finance may not be a requirement anytime soon, as the process of making electives is a long one, increasing the awareness of the class would be a step in the right direction to boost the number of students enrolled in the class. I spoke to Assistant Superintendent of Student Learning and Inclusion, April Imperio, who said that the process of creating an elective is long and difficult. In the meantime, raising awareness and increasing enrollment would make a difference.

“Highlighting something, such as Personal Finance and the way that we present it could have a lot more kids enroll in it because they want to enroll in it, not necessarily because it’s required,” Imperio said.

Having kids voice their enjoyment of the class, or having counselors advocate the course during the annual counselor meetings with the incoming classes, would be a good way to promote the course.

While the word ‘required’ can often take the enjoyment out of a course and decrease the desire to be in class, if Personal Finance was a requirement it would stand out from other graduation requirements. The relaxed environment, ample time to complete assignments, various games students play, and the amount of assistance Puishes gives students sets Personal Finance apart from other classes mandated at Groves.

“I truly believe kids need knowledge of Personal Finance to enter the world after they leave here. Just because you see so many things about young kids getting themselves into financial situations that are so hard to get out of. We want to equip you guys with what you need when you leave here in all areas of your life. Personal Finance is one that is very important,” Smith said.

I appreciate Smith’s support for this practical class, and I believe the class gives every student a head start in life and should be taken into consideration when deciding requirements for graduation. The financial knowledge that Personal Finance provides students will decrease stress in their future, give them an employment advantage, and assist them in not just avoiding crippling debt but saving or even doubling their money through wise choices. I urge our administrators to make the wise choice to move Personal Finance from an option to a necessity, as it is in our lives.

Your donation will support the student journalists of Wylie E. Groves High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.